French RetailTech: What happened in the first half of 2022 ?

Emerging trends in retail and new commerce.

For this summer period, we will be a little lighter than usual. While the tech ecosystem is currently coming to its senses, we found it interesting to present some data on the retailtech sector. In this newsletter, we will focus on the operations of the first half of the year, both in terms of investments and exits. As you will read, the market has not slowed down…yet.

Have a nice holiday !

📈 Number of investments and amounts raised by the French Retailtech companies are rising

Thanks to a historical retail culture that is well anchored in France and a deep market of French retailers and brands, French retailtech companies have benefited from an ecosystem that is particularly favorable to their development, regardless of the pandemic.

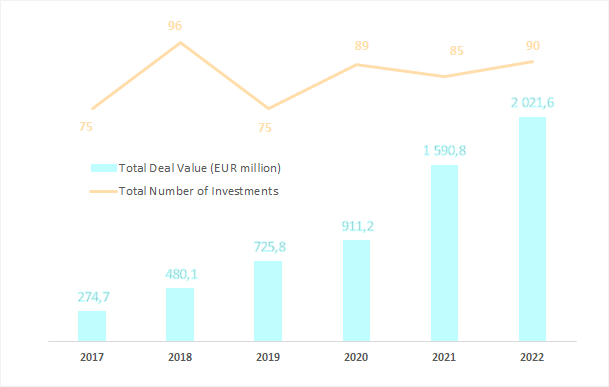

The amounts raised by French Retailech startups have considerably increased in recent years. In the first half of 2022, they raised over € 2 billion, up 27% compared to the first half of 2021.

While the amounts raised have multiplied by 7.4 between 2017 and 2022, rising from €275 million in S1-2017 to €2 billion in S1-2022, the number of deals has only increased by 20% to reach 90 deals in the first half of 2022, compared to 75 in the first half of 2017.

📊 Deal size: A heterogenous market

As a consequence, the average investment size has considerably increased over the past few years, going from € 3.7 million in the first half of 2017 to € 22.5 million in 2022 (+20% compared to the first half of 2021).

This can be explained by the increased VC dry powder over the last years leading to a rising number of deals above € 50 million (1 in S1-2017 compared to 7 in S1-2022, of which 6 raised more than € 100 million. The growing average deal size also reflects the greater maturity of the sector with an increasing number of series-B and above deals.

Average deal size actually hides the heterogeneity of the market. Indeed, the median deal has not changed that much over the last years standing at € 3 million in the first half of 2022 (vs € 2.5 million in 2021 and € 1.4 million in 2017).

♊ Even Score for Disrupters and Tech-Enablers

B2C has been neglected for a long time by investors. With the proliferation of marketplaces, new brands (DNVB and ONVB) and new models of consumption (short circuits, second hand…), B2C has become trendy again.

In the first half of 2022, the market is evenly split between Disrupters (B2C companies based on new distribution or consumption models) and Tech-Enablers (B2B companies offering solutions to retailers, e-merchants and brands) in value (€1,010.9 million and €1,010.7 million respectively), with 40 and 50 deals respectively.

The distribution between the different categories of disrupters has been globally stable for 3 years with the exception of marketplaces which have captured an increasing share of financing in recent years to reach +40% in volume and 75% in value. This trend has mainly been driven by the last financing round of BackMarket (€450 million) and Ankorstore (€250 million) in the first half of 2022. This can be explained by the initial attractiveness of these new distribution models for VCs, and the high capital intensity of the marketplace model based on weak margins requiring to reach very large volumes. The main platforms that have achieved substantial volumes have now to demonstrate their ability to generate positive cash flow.

DNVBs had their best days and are now facing a tough B2C market where increasing customer acquisition costs have severely impacted their business model and even made them unviable for some companies. ONVBs (Omnichannel-Native Vertical Brands) have proven the robustness of their native omnichannel model, but the number of players is still limited in the market as this model is harder to pull off.

Other distribution models such as second hand have thrived in recent months. However, as we pointed out in our previous newsletter, players will have to demonstrate the viability of their business model which cannot be easily replicated across different markets.

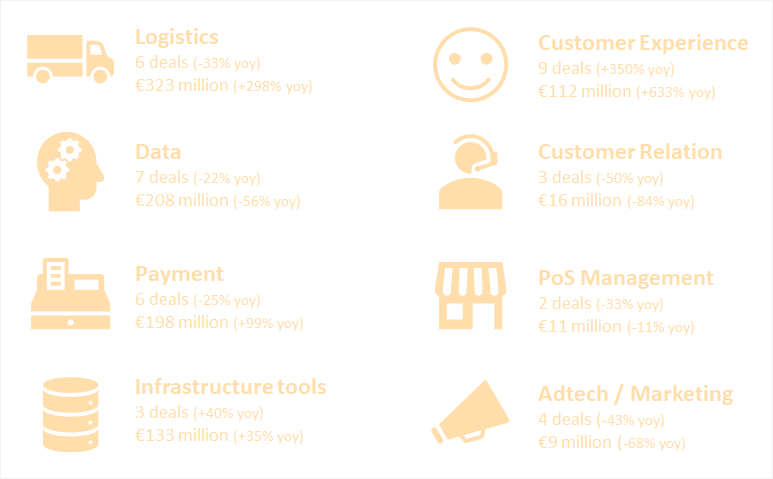

Since 2020, investments in Point-of-Sale management and animation solutions have decreased considerably, a trend that is confirmed in the first half of 2022.

With the considerable increase in logistics flows and the complexity brought by omnichannel, logistics startups (aka LogTech), have bloomed throughout the value chain (upstream, intra and downstream) and have captured a significant amount of financing like the French flagship Exotec which raised €296 million this semester.

Finally, companies tackling commerce data have considerably multiplied in recent years, capturing large amount of capital. Despite a relative slowdown this semester, the segment remains active, particularly driven by the complexity brought by omnichannel commerce.

🎯 What about Exits ?

VCs have often favored trade sales rather than financial sales, corporate buyers being more eager to pay for the strategic value of startups. This trend has been confirmed over the last few years, with trade sales accounting for more than 80% of exits.

With the growth of giga deals both in terms of number and amounts raised, a new trend has emerged with the increase in exits made by Tech startups.

Financial exits mainly concerned B2C companies, especially those that were able to reach profitability while still generating strong growth.

🔮 What’s coming next ?

Even if it is always very difficult to predict the future, especially in such a changing environment, we can imagine some major trends for the coming months:

🦄 From Unicorns to Centaurs to ?

It's not a bad word anymore. It is now accepted that the tech bubble has burst (read the great post of our colleague Xavier Lazarus explaining the genesis of the bubble) and that the market is being rationalized. What will be the impacts for the ecosystem?

As a sign of this rationalization, symbols of the startup ecosystem are changing. We have gradually moved from valuation-based metrics (symbolized by the Unicorns for companies valued $1+ billion) to revenue-based metrics (symbolized by the Centaurs for companies generating $100= million ARR). We can hypothesize that the next step will involve margin-based metrics and a reconciliation between valuation, growth, revenues, and margin. To date, it is no secret that most of Unicorns have not claimed the Centaur status yet ^^

📉 Investment strategy will adapt

It is not that easy to predict the investment trend as the dry powder is still at a very high level: $2.300 billion were available WW by the end of June 2022, three times more than 10 years ago; in France, funds financed by BPIfrance totalized €23 billion of dry powder by the end of 2021.

As the VC market is driven by the dry powder, funds will be still investing over the next coming months. But, with market valuation going down and the lack of exits for some over-valuated startups, investment strategies will certainly adapt with a greater focus and attention to the balance equity/growth/burn rate. Difficulties to refinance and to exit their late stage portfolio will probably bring VCs to target earlier stage companies with lower valuation.

📈 Increasing trade sales

VC market is also driven by exits which should accelerate over the coming months.

Many corporate acquirers have been out of the game for a while because of skyrocketing valuation they could not afford. Most of them started to acquire companies at an earlier stage. This trend should accelerate. But corporates are also likely to come back into the late game as valuations fall and startups struggle to refinance.

➕ Buy and Build strategy by Tech companies

As we have seen, acquisitions by tech companies is increasing.

Because of the macroeconomic environment, majority of companies reduced their burn rate. Organic growth can no longer be achieved at any price and will therefore be impacted. Many tech companies that have raised significant amount of capital are now working on buy and build strategies looking for companies offering additional revenues and/or additional technological offering a new exit route to startups.

🛍️ What about RetailTech ?

While acquisition costs are increasing, the focus on healthy economics for new distribution models or new consumption models will increase. B2C investments and exits will probably fall down in the coming months putting light on the best players. This trend has already begun as described by the investment bank Silverwood Partners.

B2B distribution is an emerging trend in our dealflow over the last few months ; this should accelerate as professionals are looking for solutions similar to those they are using in their daily life. Moreover, KPIs for B2B distribution are often much better than the actual B2C KPIs.

On the tech-enablers side, VCs will likely gain interest with e-commerce tools, especially those enabling unified omnichannel commerce. Tech companies have already started aggregating or consolidating the market, this trend is expected to amplify.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a European investment fund dedicated to companies that are shaping the future of commerce. We champion doers who build innovative companies making commerce better, from enabling technologies to new commerce models and everything in between. More info about our investment thesis 👉 here.