Retail Chronicles | 02.12.2021

Emerging trends in retail and new commerce.

Hello, it’s Laurent from Spring Invest, a European investment fund that is shaping the future of commerce. Welcome to the latest edition of Retail Chronicles, our newsletter about emerging trends in (e-)retail, brands, and new commerce.

There has been a couple of weeks that you did not hear from us, as we were quite busy working on our portfolio companies, new deals that are coming soon, and our new branding (see the great job made by Pelo Studio just here). We also spent lots of time with retailers, e-merchants, and brands talking about the Future of Commerce and how they are concerned with major trends arising.

For this newsletter called “We are often asked”, we decided to share some of our thoughts on questions that we were often asked. We decided to focus on 3 major trends of the market and to question the sustainability of these transformations:

🔎 Marketplace commoditization

🏪 Is Q-Commerce really the future of grocery ?

🛺 The future of last-mile delivery

Let’s go !

🔎 Marketplace commoditization

We are often asked by retailers, e-merchants, or brands if they should launch their own marketplace.

Of course, there is no obvious answer; it all depends on the market, the player, the ecosystem, the economics of the segment, and the global strategy of the company.

Here is some food for thought to help you form your own opinion.

📈 Marketplace is a huge market

2020 was an exploding year for marketplaces with a 29% increase of GMV reaching $2,7 trillion worldwide. 2/3 of the total e-commerce sales were made by marketplaces. 2021 should also be a great year for marketplaces.

The marketplace is a highly concentrated market as Alibaba, Amazon, and JD.com represent half of the market. 2/3 of the market is made by the 13 biggest players.

It is no surprise that many brands or (e-)retailers already launched or think about launching their own marketplace. But is that a so good idea ?

⚠️ Marketplace is not Retail

Retail means buying and selling products. The business model relies on trade sales. Therefore, (e-)retailers have to be good purchasers and good sellers to generate sufficient gross margin (generally 35-75%) to pay the fixed cost structure. Growth depends on the ability to find the right product to sell to the right customer at the right price. Therefore, (e-)retailers have to be primarily focused on the products.

On the other hand, Marketplace is an audience business that is not limited anymore by the products. The business relies on monetizing the audience with a take rate generally based on 8 to 15% of sales. Availability, quality, or price of the products can’t be easily controlled. Marketplaces need the largest and most appropriate content to satisfy the customer's needs. Therefore, Marketplaces have to be primarily focused on the customer.

💣Marketplace is commoditizing

It has never been so easy to launch and operate a marketplace with all the tools available today. One of the consequences is that most of the marketplaces are now selling the same products, from the same sellers, at the same price.

And that could be a major problem for marketplaces in the coming years if they do not find a way to differentiate. Some players are trying with additional services or subscriptions but will it be enough when everybody is doing the same ?

As Marketplace is an audience business, power balance will clearly be in favor of audience owners like TikTok which is testing its own marketplace with the Magellan XYZ project (more information with this great paper in french from our friend Julien).

🔮The Future of Marketplaces

We do think that successful Marketplaces will evolve in one of these 2 directions :

Marketplaces that provide a solution to a clear pain of the market like providing transparency of second-hand products such as BackMarket is doing with electronic products or Upway with electrical bikes.

Marketplaces that provide sellers with a complete infrastructure both logistics, software, and tools to optimize their sales.

Marketplaces which get stuck in the middle relying only on product aggregation may have a hard time.

🧰 Leading Marketplaces already are infrastructure providers

As a logistics and software infrastructure provider, the focus of marketplaces is now moving to the ecosystem. Those platforms provide:

A complete fulfillment service with multiple logistics facilities to help with geographical expansion;

A fully functional platform with traffic;

Advertising solutions;

A bunch of tools to manage and optimize sales;

This approach allows marketplaces to lock the relation with sellers by preventing them to work with their competitors.

When we look at some of the leading marketplaces, most of them have already moved toward an infrastructure model (see picture below).

💲 Infrastructure model, the solution to a sustainable business model ?

It is important to note that the marketplace business model does not follow the traditional retail cost structure as margins and operations are very different. Therefore, launching a marketplace is a strategy that must be very carefully considered.

The marketplace break-even point can also be hard to reach as take rates are pushed downward by the increasing competition and customer acquisition costs.

However, Amazon previously showed that a sustainable business model is not necessarily coming from the main activity. The infrastructure provider model could be the solution to make the marketplace business model sustainable.

For many years, Amazon marketplace has been operated with losses offset by high profits generated by Amazon Web Services. More recently, a significant new business line called “Other Revenues” has appeared in Amazon P&L. If Amazon is very discreet on it, analysts have deduced the presence of advertising revenue which would be estimated around $ 32 billion on an annual basis, with considerable growth over the recent months!

Retail is not magic and margins are not that easy to reach. The hybrid model could be a way for marketplaces to grab additional margin points, to reduce competitive pressure by locking the sellers, and therefore to make their business profitable.

❓What about Shopify ?

You may have noticed that we mentioned Shopify on the above graph. Shopify is not a marketplace but a CMS for e-commerce direct sales. Shopify always said that they wouldn’t build a marketplace.

However, in 2020, they launch an app called Shop that recently evolved with search and transactional functions that allow customers to buy products directly from the app (more information here). Shopify has never been closer to the marketplace world, and it could be a game-changer !

🏪 Is Q-Commerce really the future of grocery ?

We are often asked why, as a VC fund investing in companies that are shaping the Future of Commerce, we did not invest in Quick-Commerce, also known as Q-Commerce or Dark Stores.

While many players quickly emerged in a couple of months, all targeting high-density cities, it reminds us of the food delivery madness a few years ago.

Here is a summary of our thoughts.

🤔 What kind of business is Q-Commerce ?

Is Q-Commerce a retail or a logistics business ? Is it a new model of distribution ? of consumption ?

Q-commerce is essentially e-commerce selling grocery products including food and beverage with generally 1.500 to 2.500 available SKUs. Q-commerce is also a logistics company as infrastructure, processes and software must be well-tuned and efficient enough to fulfill a promise of delivery in less than 15 to 30 minutes.

In our opinion, Q-Commerce can not really be considered as a new model of distribution or a new model of consumption, as grocery e-commerce already exists and quick delivery from grocery stores has already been performed in high-density cities for a long time.

🔢 Q-Commerce economics

But the biggest question is about the sustainability of this business. Let’s dive into the economics.

Q-commerce average basket is around 25€ and gross margin around 30-35%. With a delivery cost of 4€ per order, there is only 4€ left to pay for the operations (picking, packing), the customer acquisition, and all the fixed costs. In other words, each order is a cost for the operator which is amplified today with crazy acquisition costs.

It means that, even with a very high frequency of orders, reaching profitability could be a very long shot. What are the options for the players ?

Increasing basket ?

Price: most of the consumers are price sensitive with commodities and competition with all the players does not allow price flexibility.

Volume: Not that easy as the number of articles is limited for each order to allow a quick delivery with a bicycle.

Increasing gross margin ?

Higher volumes will help to get better COGS from suppliers for sure but will it be enough ?

Product mix could also be a solution but will not be that easy as Q-Commerce is a destination platform where the consumer goes when he knows exactly what he needs.

These numbers lead us to 2 additional questions:

How to efficiently operate an e-commerce business with small basket, 35% gross margin and high operating costs and capex ?

How to succeed where food delivery platforms have difficulties to find a path toward profitability with similar basket size but enormous volume, higher frequency of buying and lower cost structure and capex ?

🪶 Q-Commerce, a step towards an asset light business ?

The answer to question 1 may come from Michael Moritz, the famous VC of Sequoia Capital.

Veteran VCs remember how the US company Webvan providing grocery delivery in less than 30 minutes became one of the biggest fails in the 2000s with $800 million lost in nearly 3 years of time (+2000 people lost their jobs).

Its founder Louis Borders explained a couple of years later the difficulties they were facing of:

operational issues that were much harder than anticipated,

a highly price-sensitive market preventing them to adjust the price,

a competition with traditional players that uses external delivery services to deliver from their stores.

Michael Moritz was in charge of Webvan investment for Sequoia in the 1990s. More than 10 years later, he invested in Instacart. He was then asked by a journalist what was the learnings of Webvan investment and why Instacart is not Webvan. He answered that businesses are completely different as Instacart is a “crowdsource model for home delivery of groceries” that “offers a way to escape the enormous capital infrastructure burden that was one of the things that were so tricky and complicated about Webvan”. He added:

“Webvan was a company that was, in computer parlance, trying to design the underlying computer architecture, the operating system then a whole bunch of applications on top of it.”

For sure, times have changed, 2021 is not 2000, but have the issues encountered in the 2000s now been solved? Low margin, high capex, many hard jobs to manage at the same time (logistics, warehouse multiple locations, customer acquisition…) remains key factors of the business.

Therefore, as Michael Moritz suggested, an asset-light version of Q-Commerce may be the clue of this business and could be the strategy that main players will embrace tomorrow. Q-Commerce would finally become a logistics business, especially a last-mile delivery business.

Why did large retail players make partnerships with Q-Commerce players over the last months ? We can guess that it could be a way for them to learn how this market is working and then decide to use their own high-density network of stores instead of these dark stores.

🍴 Q-Commerce may finally be considered as a segment of the food delivery market

But the 2nd question is remaining. Why this model should perform better than food delivery as operated by UberEats or Deliveroo regarding the economics of both businesses?

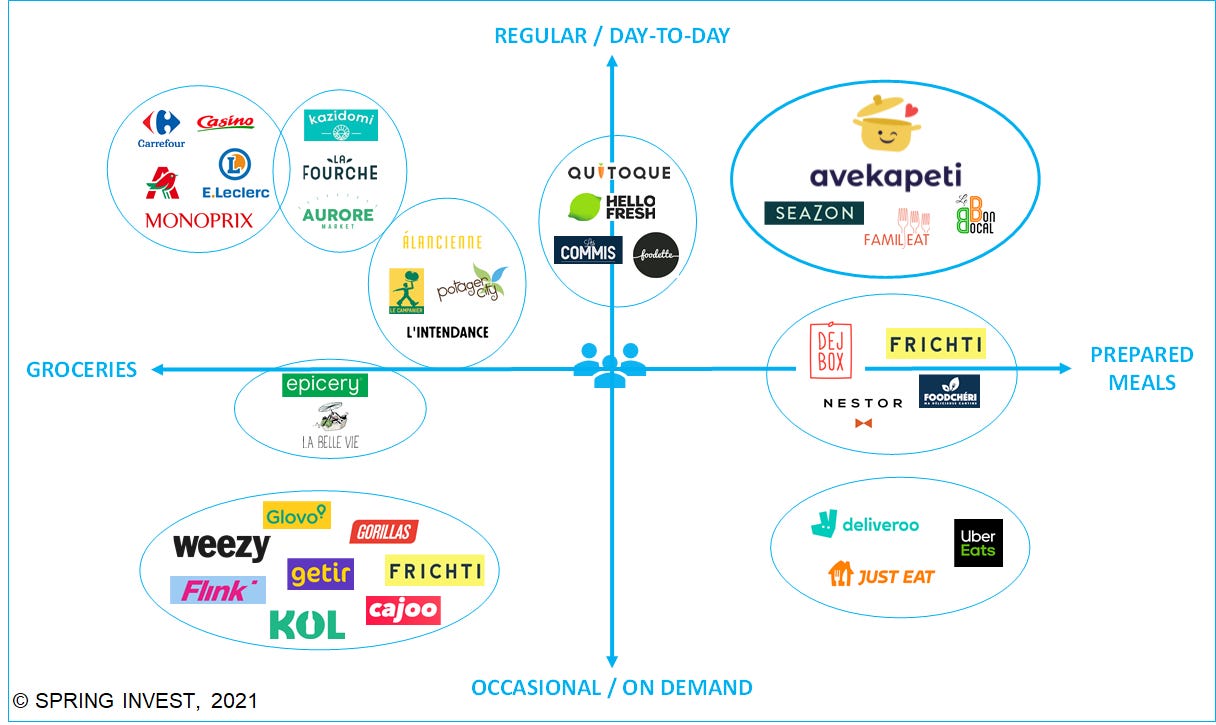

The answer may be the purchase frequency. Groceries are recurring and necessary orders. Therefore, Q-Commerce could be considered as an alternative to other daily food providers. We made the exercise with Spring classifying the different solutions that exist on the French market (see the graph below).

We are just at the beginning of the Q-Commerce battle that will probably last for a while, considering the amount of money poured into the market over the last months. If we can’t guess who will be the winner at the end, we know for sure that customers are the winner for now.

🛺 The future of last-mile delivery

We are often asked by omnichannel retailers which company they should contract with to provide a last-mile delivery service as the number of players exploded over the last months.

Maddyness recently reported that the number of last-mile delivery companies increased by 46% in 2020 compared to 2019 with 87.900 new companies, most of them being as a freelance status. This does not come as a surprise as e-commerce logistics needs boomed during and after the pandemia.

This comes with increased traffic flows in cities but also environmental issues that politics are starting to monitor closely. How will last-mile players adapt to the market in a near future ?

The transformation already began with the multiplication of (micro) urban hubs that bring logistics closer and closer to the customer, one of the consequences being the inflating price of real estate as stated this week in a Wall Street Journal paper. With the Neighborhood Delivery Hub, Seattle has been experimenting with the massification of logistics flows through shared urban hubs for all the last-mile logistics services (e-commerce, food delivery…)

Mobile hubs are also developing. They rely on electrical trucks parked in dedicated parking slots that bring the products to the last meter. These mobile hubs can also be used as pick-up points which open up the possibility of creating new services such as a return logistics service that could be operated with a lower cost.

Finally, last-mile delivery by drones is coming to reality. Last june, Walmart announced an investment in the delivery drone company DroneUp after a trial of hundreds of drone deliveries from Walmart stores over a year period.

“The trial demonstrated we could offer customers delivery in minutes versus hours.”

Last week, Walmart and DroneUp announced the launch of their first multi-site commercial drone delivery operations from drone hubs with a promise of delivery in less than 30 minutes from 8am to 8pm, 7 days a week, for eligible Walmart customers.

What would be the next step for last-mile delivery ? Autonomous delivery could be the next one as Walmart invested in Cruise, the all-electric self-driving company, at the beginning of the year.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a European investment fund dedicated to companies that are shaping the future of commerce. We champion doers who build innovative companies making commerce better, from enabling technologies to new commerce models and everything in between. More info about our investment thesis 👉 here.