Retail Chronicles | 11.02.2021

Emerging trends in retail and new commerce.

Hello, it’s Alexandre from Spring Invest, a French investment fund that is shaping the future of commerce. Welcome to the latest edition of Retail Chronicles, our bi-monthly newsletter about emerging trends in (e-)retail, brands, and new commerce.

🎙️ Clubhouse, what’s in it for consumer brands?

As a reminder, Clubhouse is a new type of social network based on voice - where people around the world come together to talk, listen and learn from each other in real-time. The app was released in early 2020, available on invitation and iOS only. Since then, the phenomenon has grown exponentially, now attracting millions of users each month, and regularly described as “the next big thing” in social networks. In January 2021, the startup raised $100 million at a $1 billion valuation, led by Andreessen Horowitz (read the investment story here).

There are still many questions around Clubhouse’s future, like the business model, the moderation, the privacy, etc. but there is something unprecedented here that deserves our attention. Like many other social networks, there will probably be a place to take for brands. We are still in the early days but here is a list of a few ideas on how consumer brands could benefit from a presence on Clubhouse :

➡️ Acquire new customers: we see more and more sponsored rooms where brands showcase their products, their benefits, tell the back story, how products are being used, etc. and eventually share a discount code (from 5 to 50%), available for the duration of the event to create scarcity. Surprisingly in a world that is moving towards video-shopping, brands say it drives traffic to their Instagram accounts and e-commerce websites as potential customers are desperate to see pictures while listening to a new way of presenting a product based on audio. This new format is highly interactive for customers as they can ask questions but also for young brands that can test value proposition and see how customers react and what is important to them.

➡️ Boost e-commerce conversion: some brands are starting to think about opening a 24/7 room for “last-minute questions” from customers who are about to buy a product online but do not find the answers to their questions (size, return policy, warranty). Customers can therefore join the room and simply ask the question. It can be very difficult to moderate but also promising for brands, since understanding non-conversion is one of the major blindspots of e-commerce merchants. Indeed, it is now fairly easy to track and understand how and why a customer makes an e-action, but it is still very hard to understand why they DON’T do something. Clubhouse could open a new conversation channel, therefore challenging the aging customer support chatbots with a more interactive and human touch. Some brands are even talking about building a « Peer2Peer customer support » where existing customers could enter a room as a speaker and answer questions from other potential customers.

➡️ Gather feedback from customers: most modern brands are already using different mediums to gather customer feedback (private events, Typeform, texting, direct calls, etc.) and empower customers. The best brands even manage to leverage the relationship with customers to co-create the next products to launch. However, Clubhouse offers a very convenient alternative for customers to speak up while interacting with each other as a community. On the medium itself, early adopters say it’s much more fun to engage with a brand in Clubhouse than filling up a Typeform.

➡️ Improve brand awareness: we see more and more brand founders using Clubhouse to speak up about several highly engaging matters like diversity, inclusion, gender equality, salary transparency, explaining how they take them into consideration while managing their startups. Of course, this could also be done with articles and podcasts but again, this live format sounds very much « authentic ». Indeed, founders can’t hide behind a well-articulated article written by a top PR agency. They are here, now, live, with their strengths but also weaknesses and doubts. That way, brand story-telling sounds very much authentic, a true revolution in a world of everything-washing.

In addition, companies are also leveraging clubhouse for other corporate matters like finding smart money and advisors by pitching VC and business angels or recruiting talents by launching « Ask-me-anything » rooms about their culture while sharing open positions.

CONCLUSION: These mechanics may sound relatively long-shot for most brands but Clubhouse is spreading very fast, and media positions on social networks are easier to take in the early days when the audience is eager to participate, engage in rooms and join brand’s clubs than later down the road when the media will be too crowded. Bottom line, there is room to test things and very few downsides trying.

🛍️ E-commerce 2020 in 6 numbers

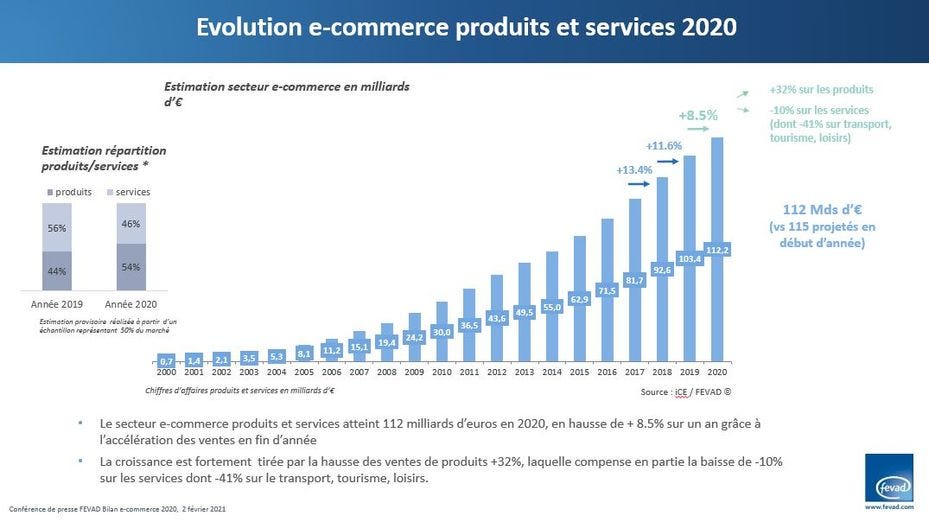

The FEVAD has just released its annual report about French e-commerce :

Volumes have increased from 103,4 to 112.2 billion € (+8.5%)

E-commerce market share is now at 13,4% (we've been gaining roughly up to one point of market share per year, so in 2020 we have gained 3-4 years of growth)

41,6 million e-commerce buyers (+1,5 million vs. 2019)

Product sales have jumped + 29% (with or without marketplace) and + 42% for FMCG alone (food), and + 25% for non-food (best categories being beauty, health, furnishing and decoration)

Omnichannel business have made the most progress with gains of 53% (and peaks of + 100% during lockdowns) against 11% for pure-players

Click and collect has exploded with more than 41% of users (vs. 28% in 2019)

Read more on LSA here.

📊 Facebook : winning over e-commerce advertisers

For years, major social media companies like Facebook have been fighting to win over retailers’ and brands’ advertising budgets by pitching themselves as the new go-to place that people go to discover and find new products.

That’s why they’re constantly looking for new advertising formats and features that they can say gives them an edge over the other platforms. And that’s also why they are all copying each other to fight against these hedges, the most recent example being the “stories”, initiated as a core format by Snapchat, then copied by Instagram, Facebook. and Twitter.

➡️ Checkout: the feature allows people to buy products directly from retailers and brands’ Instagram accounts without having to leave the app. Interestingly, the launch of Checkout shows that Facebook started to take on more responsibility for other parts of the buying process. For example, Facebook sends order and shipping confirmation emails to the customer. Problem: brands have to give up some control over the customer’s relationship, which may explain why only “hundreds” of retailers are using it.

➡️ Shops: working closely with the big CMS providers (Shopify, BigCommerce, and WooCommerce), companies on Facebook Shops can direct customers to purchase either through their own websites or through Facebook’s own Checkout (if the company has that enabled).

➡️ Live: In addition to the Facebook Live test that enables Pages to showcase products in their stream, Facebook recently acquired a video commerce startup Packagd, which is focused on enabling users to make direct purchases of products via live-stream, unboxing-type videos.

➡️ Support: Facebook recently made the acquisition of Kustomer, a startup focused on customer service technology and chatbots. As a reminder, Kustomer's platform provides a single-screen view of conversations between businesses and consumers among different channels (phone, email, webchat, and messaging) to help customer service agents minimize repetitive tasks.

More here from Anna Hensel about other players (Google, Snapchat, Pinterest, and TikTok)

🎧 Podcast : Spring x Le Café de l’E-commerce

Laurent has been invited by Le Café de l’E-commerce on its podcast 100% focus on e-commerce, digital and social media for the #069 episode. We are discussing many things like DNVB, ONVB, consumer brands, e-commerce tools, the growth of Shopify, what KPIs we are expecting as investors, etc.

Other topics on the menu: Alma 49 million € fundraising, Jules clothing repair service, Maison Verte product subscription, Barilla Group playlist for pasta al dente, Amazon in Poland, and Céline X TikTok.

➡️ Link to listen to the podcast : here.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a French investment fund dedicated to companies that are shaping the future of retail. We invest both in Enablers, B2B companies providing innovative solutions to (e)retailers and brands, and Disrupters creating new models of distribution. Our investment approach relies on strong relationships with 50+ European Retailers and Brands in order to provide sales acceleration to our portfolio. We also provide operational support with a dedicated team of Venture Partners working with our portfolio on sales, communication, HR, and internationalization.