Retail Chronicles | 12.05.2021

Emerging trends in retail and new commerce.

Hello, it’s Alexandre from Spring Invest, a French investment fund that is shaping the future of commerce. Welcome to the latest edition of Retail Chronicles, our bi-monthly newsletter about emerging trends in (e-)retail, brands, and new commerce.

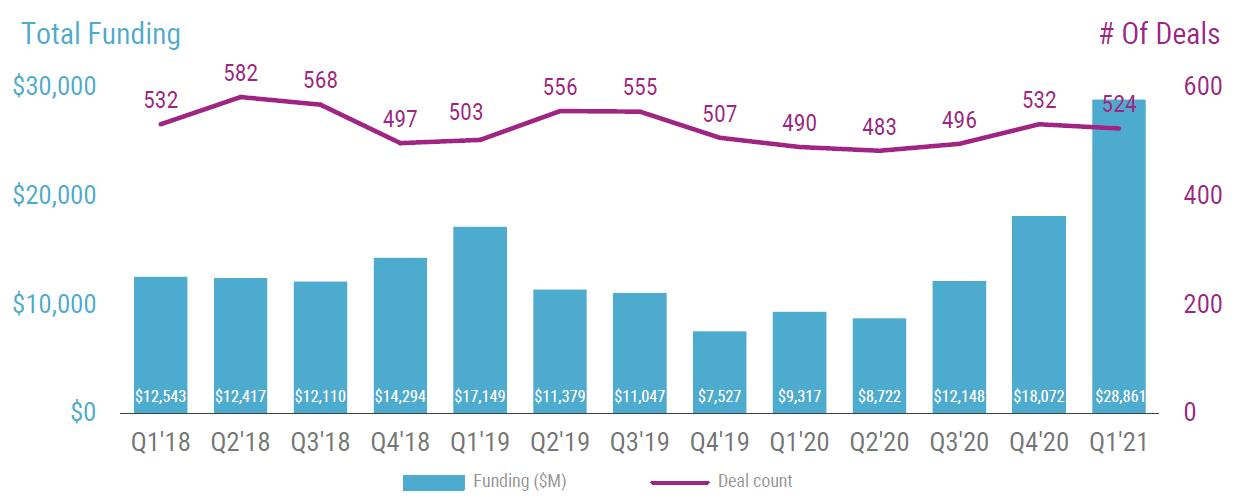

🔥 RetailTech funding at an all-time high

The CB Insight report shows that retail tech funding tripled in Q1 21 (vs. Q1 20) to 28.9 Bn$, mostly driven by mega-rounds and delivery. Indeed, Q1 21 had 73 mega-rounds (deals worth 100m$+), up from 33 in Q4 20, leading to 14 newly born unicorns. The 5 biggest are Weee (grocery delivery - 2.8Bn$), Getir (grocery delivery - 2.6Bn$), Dutchie (marijuana marketplace - 1.7Bn$), Yotpo (customer review management - 1.4Bn$) and Paidy (buy now pay later - 1.3Bn$).

As for the business trends, here is what retailers and brands are focusing on :

Personalizing the checkout-free experience with smart shopping carts (Veeve) and scan-and-go apps (Supersmart).

Making store communication more efficient with communication platforms (Foko retail, Zipline).

Personalizing e-commerce experiences with personalized search results (Bloomreach), personalized merchandising (Compat.io), virtual try-on (for makeup with Perfect or fashion with 3DLook), live streaming platforms (Kuaishou, Hero, Livescale).

Boosting loyalty with transferable rewards such as crypto tools (Lolli), cross-brand wallets (Swapi), and convertible reward programs (Bakkt).

Strengthening cybersecurity with fraudulent behavior tracking tools (Arkose Labs) and data privacy management platforms (Wirewheel).

Optimizing the supply chain with visibility tools (Fourkites) and on-demand warehousing solutions (Flowspace).

Upgrading to on-demand delivery with platforms connecting brands and retailers to local delivery carriers (Bringly, Ohi).

Last but not least, one item is flagged by most brands and retailers as the number one strategic priority: OMNICHANNEL. See below the number of earnings calls mentioning the word “omnichannel” for the past 5 years.

🏭 Manufacturing + 📱 Influence = 🛍️ Product Brands ?

You probably have already heard of brands being built by celebrities. There are hundreds of them: Ivy Park (Beyoncé), Victoria (Victoria Beckham), CR7 (Cristiano Ronaldo), FORVR (Jackie Aina), Skims (Kim Kardashian), …

In most cases, these brands are simply “powered by celebrities”, meaning that agencies are designing the products, sourcing the manufacturers, creating the brand identity, managing the distribution channels, while the celebrity posts on Instagram.

It seems unfair, right? Well, having an audience is what pays out these days.

From an influence perspective, this brand-building methodology has worked for years but only for mega influencers (actors, athletes, singers, etc.) so far.

Now, the question is: Could you make it work for smaller influencers ?

Interestingly, Pietra has recently launched its new marketplace to “democratize” influence-led retail, by allowing any influencers (from 1 to millions, being the mid to long-tail) to create their own product lines.

The platform connects creators with pre-vetted product designers, suppliers, manufacturers, photographers, and warehouse companies. That way, influencers can use the solution to make branded items in various categories such as coffee, clothing, fragrances, and makeup. So yes, now all creators need to launch a brand is a phone and an audience.

“Anyone with the drive and motivation to bring their idea to life can get access to the same infrastructure that the top creators historically have gotten. You no longer need to fly around the world, find a factory, beg them to work with you, plead for low minimums. We're trying to build a world where a creator, a single creator, can create the next best-selling brand.” Ronak Trivedi, CEO of Pietra

How does it work and how much does it cost ?

Designing products before it goes into production is free. The influencers cover the costs of manufacturing any items they design. Pietra charges a handling fee (0-4$) for any samples ordered, and a flat production fee to create up to 500 units of an item. It charges incremental fees for any product assembly, quality assurance, or warehouse work after the first 500 units are made (99$+ 0.25$ per additional unit). Finally, they charge a fee for services such as shipping and fulfillment (1$ in addition to the costs).

In return, Pietra helps with negotiations around issues like minimum order volume, deposits, and cross-border logistics. On the supply side, Pietra’s suppliers are audited, used by top retail brands, and offer the option to produce fair-trade, kosher, vegan, or cruelty-free products.

Once the creators have the products ready, they can either build their own e-commerce on Shopify (starting at 29$/month + 2% transaction fee) or sell their products directly through the company’s creator marketplace (5% transaction fee + 1$ per unit sold),

Is it really working ?

The concept is not entirely new (Moteefe, Spri.ng, Icon) but creators seem to love the one-stop-shop approach: 300 product lines were created during the beta period and 15,000 creators are on the waiting list to launch a product line. According to Pietra, most of these users are women, at about 80%, and their followings range from tens of thousands to millions (going back to the chart above we are talking about Macro & Mid Tier influencers).

Even though the value proposition seems very compelling for creators, it is quite unlikely that these influencers will be able to build successful tier-1 brands, especially with such commoditized products. Also, competition is fierce as there have never been so many brands on the market. By further lowering the barriers to entry it will simply intensify. On the other hand, and that is the beauty of the model, all creators do not need or want to build a tier-1 brand as selling branded products is also a way of diversifying their monetization options (even on a small scale) while strengthening the relationship with their audience.

🎙️ Ok Google, “Are you a retailer or a marketplace ?”

In this very interesting podcast, Google’s commerce president Bill Ready is talking about the growing shopping ecosystem. Key takeaways of the discussion :

➡️ Opening up the shopping ecosystem

For years, if a merchant wanted to list a product for sale on Google, they needed to buy an ad to do that, basically buying a customer from Google. In other words, it was an ad-driven product. Last year, Google made it free for any merchant to list all their products for sale. By doing that, the company saw 80% more listings in 2020 compared to 2019. The problem is that still very few customers actually want to buy directly from Google Shopping.

➡️ Is Google a retailer or a marketplace ?

We’re not a retailer, we’re not a marketplace. Google is about helping shoppers discover products, and sometimes letting them transact with in the platform. While the site looks and feels like a marketplace, Google’s utility provides something markedly different : we want to make sure users can discover the best products, the best values, the best sellers, and then seamlessly connect to those to those sellers.

The problem is that most of the time, helping the users actually means clicking out to the seller’s own website, which was fine as long as it could fuel the ad business but does not work for ad-free products (that were supposed to be bought directly on Google Shopping). That is why Google remains first and foremost an ads business as most of its decisions come down to maintaining its relevance in the ad world.

As in many businesses, the greatest threat comes from Amazon as they are continuously improving their own advertising infrastructure for merchants while optimizing the search engine for users, now generating 20$Bn in revenues as a lot of CPG brands have recently moved their budgets into the platform (read more here What Amazon is Turning Into? and here Amazon advertising business).

➡️ More shoppable video features

Google thinks there is a big opportunity for shoppable videos and bringing more shopping into video consumption, especially on Youtube. From their perspective, there is a tremendous amount of commercial intent on YouTube already with how-to videos, unboxing, and product testing. Google is therefore trying to bridge the gap between the discovery phase and the transaction phase.

📖 AAA+ reading list

➡️ It’s time to unbundle Instagram

➡️ Distribution and conversion models for consumer startups

➡️ Lessons launching and scaling a D2C startup

➡️ The startup guide to building successful OKRs

➡️ There’s only a few ways to scale user growth

🐦 Tweet of the week: harder, better, faster, stronger

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a French investment fund dedicated to companies that are shaping the future of commerce. We invest both in Enablers, B2B companies providing innovative solutions to (e)retailers and brands, and Disrupters creating new models of distribution. Our investment approach relies on strong relationships with 50+ European Retailers and Brands in order to provide sales acceleration to our portfolio. We also provide operational support with a dedicated team of Venture Partners working with our portfolio on sales, communication, HR, and internationalization.