Retail Chronicles | 17.01.2022

Emerging trends in retail and new commerce.

Hello, it’s Xavier from Spring Invest, a European investment fund that is shaping the future of commerce. Welcome to the latest edition of Retail Chronicles, our newsletter about emerging trends in (e-)retail, brands, and new commerce.

📈 DTC Dynamics

The Direct To Consumer (DTC) landscape is facing some headwind.

🛑Market is not growing as fast as expected.

When Covid-19 struck, everybody thought it had propelled ecommerce 2-3 years into the future.

We were wrong.

It was just a bump. We reverted to normal. US numbers show that ecommerce penetration is now back to where it would have been without covid-related lockdowns.

According to Fevad, French numbers tell the same story: ecommerce fell back to the pre-covid growth curve.

The market is still growing healthily, but we left the exuberance of spring 2020, we’re back to the realm of bean counters, where unit economics such as margins and average baskets are paramount.

💥Acquisition costs are increasing

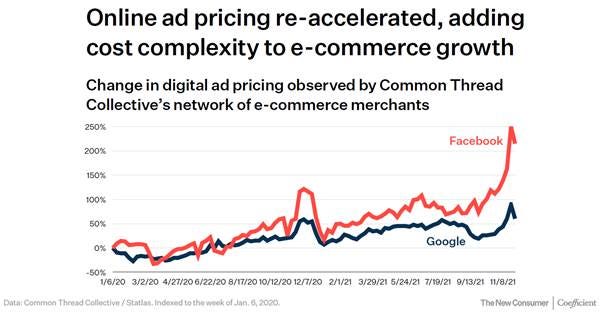

Speaking of unit economics, DTC players faced increased acquisition costs after the summer of 2021.

People at Common Thread Collective documented a steep increase in online ad pricing.

In a recent blog post, they present a goldmine of data all pointing to the same direction: Facebook ad performance has seriously decreased.

Facebook ROAS (Return on Ad Spend) went from 2.04 in 2020 to 1.72 in 2021 (-15,7%)

Blended ROAS went from 5.70 in 2020 to 4.78 in 2021 (-16.3%)

Facebook CPM (Cost per 1k impressions) went from $9.05 in 2020 to $13.70 in 2021 (+51.5%)

This is consistent with anecdotal data we gathered by talking to DTC brands operating (mainly) in France. While blended acquisition costs as a percentage of sales used to stay in the vicinity of 30-35%, they grew up to 40% after summer 2021.

An obvious reason is the introduction of iOS 14.5 by Apple in May, 2021. All iPhone users received an App Tracking Transparency (ATT) option allowing them to opt-out of data tracking in apps. This has reduced Facebook Ad’s relevancy and reduced users’ Click-Through Rate (CTR).

Other possible reasons are (i) excessive growth expectations from brands anticipating that the covid boost would endure, (ii) inflow of VC money on DTC startups, (iii) impact of Asian supply chains disruption with some players trying too hard to compensate for missed targets, or (iv) arbitrage with the Amazon ecosystem where ad pressure also increased sharply (see below).

👉 Our thoughts

At Spring Invest, we believe higher acquisition costs are here to stay. This comes with numbers of interesting consequences:

This is bad news for Meta and Google. Mobile is increasingly the default device for users and iPhone has a huge market share in the US and EU.

This is bad news for Shopify as most of its DTC customers still rely on Facebook/IG or Google for consumer acquisition.

Many DTC players will realize that they no longer have a business model. High gross margins (75%+), great products and strong differentiation are more than ever necessary.

Omnichannel is king. Efficient physical retail channels enable stronger growth and reduce dependence on FB/Google.

This also highlights the need for new acquisition channels. Ads are blunt and invasive. At Spring Invest, we’re actively searching for startups helping consumers find the products they don’t know they need.

🔥 Amazon Sellers Aggregators

ASA or Amazon Sellers Aggregators (also called Amazon Aggregators, FBA Aggregators, or Amazon rollups) made a major sensation in 2021. A hundred or so players around the world raised more than $12Bn of joint equity and debt. Even though the largest and earliest player, Thrasio, started in 2017, the model really began to take-off last year as shown by quarterly fundraising :

Q2, 20: $108m

Q3, 20: $352m

Q4, 20: $511m

Q1, 21: $2,258m

Q2, 21: $2,824m

Q3, 21: $3,798m

Q4, 21: $3,423m

The ASA business consists in acquiring a large number (tens or hundreds) of independent Amazon sellers, integrating them and developing them.

❓Who are the independent Amazon sellers?

In 2021 consumers purchased an estimate of $610Bn worth of goods (+24% vs 2020). Most of these 610Bn are not actually sold by Amazon but by independent sellers using Amazon's marketplace to reach consumers. Amazon marketplace sales amounted to $390Bn (+30% vs 2020) in 2021 representing 64% of Amazon's total volume. In 2011 it was only 38%.

According to Marketplace Pulse, there are more than 10 million seller accounts on Amazon representing 6 million unique sellers (some sell in several countries). Roughly 800k new sellers join Amazon every year. 50,000 exceed $1m in revenue.

⭐ What makes them desirable for ASAs?

A major reason why Amazon sellers are good acquisition targets is that, unbeknownst to many, they hold actual assets. An Amazon listing with its ranking, reviews and ratings is pretty durable and easy to defend.

Most ASA are looking for the following features:

#1 or #2 spot in a given category : high number of reviews, good rating.

Niche category : to avoid face to face competition with major brands.

Critical mass : at least $1-5m revenue.

Profitable : at least 15-20% EBITDA.

Non-cyclical, non-fashion, low returns products : typically home improvement, kitchen, babycare, petcare, sport, beauty, hygiene…

FBA : logistics Fulfilled by Amazon

Various ASA have specific criteria : some invest all over the place while others focus on a few verticals, some respect strict ESG rules…

💰 How do ASA create value?

A central element of the ASA model, and in our opinion, the main reason the segment drove so much money in 2021, is the "multiple arbitrage". Basically, you buy an asset at 3-5 x EBITDA and integrate it into a company trading at 15-20 x EBITDA. Considering a 3-5 x debt leverage.

Beyond multiple arbitrage, ASA can count on several ways to improve the value of the Amazon sellers they purchase :

The Amazon flywheel : as mentioned above, an Amazon listing is durable and defensible. If quality and service are high, it can even be strengthened as good reviews attract more buyers who post more good reviews.

Integration and cost reduction : ASA can reduce variable costs by mutualizing between many sellers transversal processes such as sourcing&supply, content, SEO, review management…

International expansion : many Amazon sellers only operate on a small number of markets, launching them into every country covered by Amazon is an obvious move.

Other marketplaces : similarly, if it works on Amazon it might work on other marketplaces such as Walmart or country-specific leaders.

Better sourcing : this is getting harder. Leveraging size to improve products, costs, deliveries is tempting but not easy.

FBA->FBM : even harder. It's about internalizing logistics, moving from Fulfilled by Amazon to Fulfilled by Merchant. There may be up to 5 margin points to capture, but it requires strong expertise, high capex and is not devoid of risks.

Shopify and DTC: still harder. Get beyond marketplaces and sell directly to consumers. Requires a whole lotta new skills (notably ad related) and most Amazon brands/products are not strong or differentiated enough to perform in that space.

Brick&mortar: offline sales still account for 75% of commerce. But it is very, very different from selling on Amazon.

Organic growth : Amazon's marketplace naturally grows 30% per year, just surf the wave!

🛑 So why didn't we invest in ASAs?

At Spring Invest, we've looked long and hard at the ASA segment and met a number of teams. For now, even though they were talented and dedicated, we've decided against an investment. The main reasons are:

Multiple arbitrage is not sustainable: In open markets, arbitrage opportunities only last until the rest of the market catches up. In the case of ASA, the financing stampede of 2021 was just that : the market catching-up. The immediate reaction of a market to a demand shock is a price change, and sure enough, acquisition multiple of Amazon sellers have soared in 2021, going from 3-4xEBITDA in Q4, 2020 to 4-8xEBITDA in Q4, 2021. And we probably haven't witnessed the end of the increase.

SDE is not EBITDA: Actually ASA don't use EBITDA as a metric but SDE which stands for Seller's Discretionary Earning. It is basically EBITDA before founder's compensation. Using that metric makes a lot of sense since a founder's decision to get paid in salary instead of dividends doesn't change the value of the underlying business. But one shouldn't forget that the founder is contributing work that will have to be paid for after the business is integrated into an ASA. Also ASA incur significant overheads : the M&A team and the whole structure. All in all, we found that the EBITDA margin (in % of sales) of an ASA is 7-15 percentage points below the SDE of the sellers it purchased. In terms of acquisition multiple, the impact is massive: acquiring a seller earning a 20% SDE margin at 6xSDE translates into paying 12x its corresponding 10% EBITDA margin. Not so exciting.

What to do with the founders: the Amazon marketplace is one of the most ruthlessly competitive business environment and founders of successful Amazon sellers are not here by chance. ASA, as they purchase dozens of Amazon businesses, have to quickly and repeatedly decide whether they want keep the founders, for which task, responsibility or compensation. Then they have to make all those small business founders work as a team. Harder than trying to discipline cats.

Pressure on margins: in addition to the "normal" pressure of competing against the whole world, Amazon sellers are increasingly forced to pay large advertising fees to Amazon to improve their products' exposure. We’ve already talked about Amazon's ads revenue, it is expected to exceed $30Bn in 2021, representing more than the total profit of the company. For sellers, the average cost per click rose from $0.93 to $1.33 in 2021, while the conversion rate remained flat around 12-13%. Bottom line: advertising costs for a seller rose from 20-25% of sales in 2020 to 30-35% in 2021. A drop of 10 or so margin points in one year is massive. Amazon listings may be sustainable but their maintenance is not costless.

Don’t dig for gold, sell picks and shovels: as the market heats, both Amazon sellers and ASAs need powerful data analytics tools to get insights on products, SEO, advertising, pricing, niches, market watch, etc. Futhermore, omnichannel e-commerce became more and more complex to manage as the number of distribution channels are multiplying. Last summer, we decided to invest in DataHawk, a fast-growing company providing Amazon (and now Walmart and other shopping places soon) sellers the tools to increase sales, optimize margins and boost productivity.

👉 Our final take on ASA

At Spring Invest, we never really believed in the pure financial play of multiple arbitrage in a long run, and anyway, that ship has sailed. The difference will now be made in operations : sourcing, branding, content, product etc…

Amazon is the biggest marketplace on the planet and represents an untapped treasure trove of market data (niche product discovery, price elasticity…) We firmly believe teams with strong operational expertise can and will extract this data and leverage it through various means beyond acquisition such as bundling, high throughput product development or regional customization, in combination with an omnichannel strategy.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a European investment fund dedicated to companies that are shaping the future of commerce. We champion doers who build innovative companies making commerce better, from enabling technologies to new commerce models and everything in between. More info about our investment thesis 👉 here.