Retail Chronicles | 19.03.2021

Emerging trends in retail and new commerce.

Hello, it’s Laurent from Spring Invest, a French investment fund that is shaping the future of commerce. Welcome to the latest edition of Retail Chronicles, our bi-monthly newsletter about emerging trends in (e-)retail, brands, and new commerce.

💬 Social Commerce is leading the future of commerce

Médiamétrie recently published some data regarding current internet usage in France:

8 out of 10 French people consult at least one social network;

Under-25s spend 2h12 each day on social networks (50% of surfing time), the rest of the population spend 45' on average;

French people are visiting 2.7 social networks on average every day (3.9 for 15-24 yo);

27% are using social networks to discover new products.

It will come as no surprise that social networks are becoming a new playground for brands and distributors. New initiatives have been gaining traction over the latest few months.

➡️ WhatsApp.

WhatsApp now is a new channel for customer relationship management, allowing to engage in conversation with the customer in a familiar environment. LSA recently published a review of use cases experimented by a few brands and retailers such as Carrefour, Lidl, Go Sport, Nespresso, or Fnac.

➡️ Instagram.

Instagram is a popular social network for brands working on their image. This channel is particularly adapted to decoration or cosmetics such as Clarins, whose weekly revenues have increased by more than 40% through social networks.

➡️ Pinterest.

With 459 million monthly active users worldwide watching a billion videos per day, Pinterest recently announced that it was building a place to shop with the launch of several services dedicated to retailers and brands:

Pinterest Première, a new video ad offer for retailers to push their products at the right moment on the right audience;

Pinterest Conversion Insights, a new measurement tool to better understand their impact and performance on the platform;

Pinterest’s Try on, a feature allowing to virtually try on some products by users;

Pinterest Pins and Lens features to help users find more easily the product they love and click to buy it.

➡️ Twitch.

This video social network has been popular with gamers and related brands for a long time. Twitch (acquired by Amazon in 2014) is now used by all kinds of brands, especially in the beauty industry like Burberry or luxury industry like Lexus. Modern Retail dedicated a paper to explain why brands are investing in this new channel which brings together 7 million people each month (Why So many brands are testing out Twitch). The main lessons are:

The audience is no longer limited to the gaming community;

Twitch allows for Amazon affiliate links which makes a great channel for ANVB (buying directly from the channel is not allowed yet);

Brands can launch their own channel or sponsor an influencer;

Twitch allows brands to reach night owls customers;

Twitch is a social network that works on an intuitu personae basis, therefore it really depends on the streamers chosen by the brands that must be authentic;

The format relying on many hours streams make it difficult for brands to control the content.

➡️ TikTok.

TikTok is another trendy video social network that many players have been using for a couple of months now. After a successful pilot last December, Walmart made a second livestream shopping experiment on TikTok last week. La Redoute also experimented the platform with La Redoute Challenge. Even Amazon, which owns Twitch, is using the TikTok social network to reach new customers. The new Abd Al Malik series, Cité, that is produced by Amazon Prime Video will thus be exclusively published on TikTok!

Tiktokification became a common word as more and more people are now looking for products that have been seen on the platform on the different marketplaces. As an example, “TikTok leggings” is one of the most-searched terms on Amazon since February. As announced earlier this year, TikTok will adapt its strategy and will aggressively expand into the e-commerce space in 2021 allowing users to share referral links to products and automatically earn commissions on it.

Social networks are clearly offering brands and retailers new ways to sell products. Social commerce is expected to reach 315 billion dollars in the US in 2021. However, brands must be careful as influencers may finally become the new retailers owning the customer relationship.

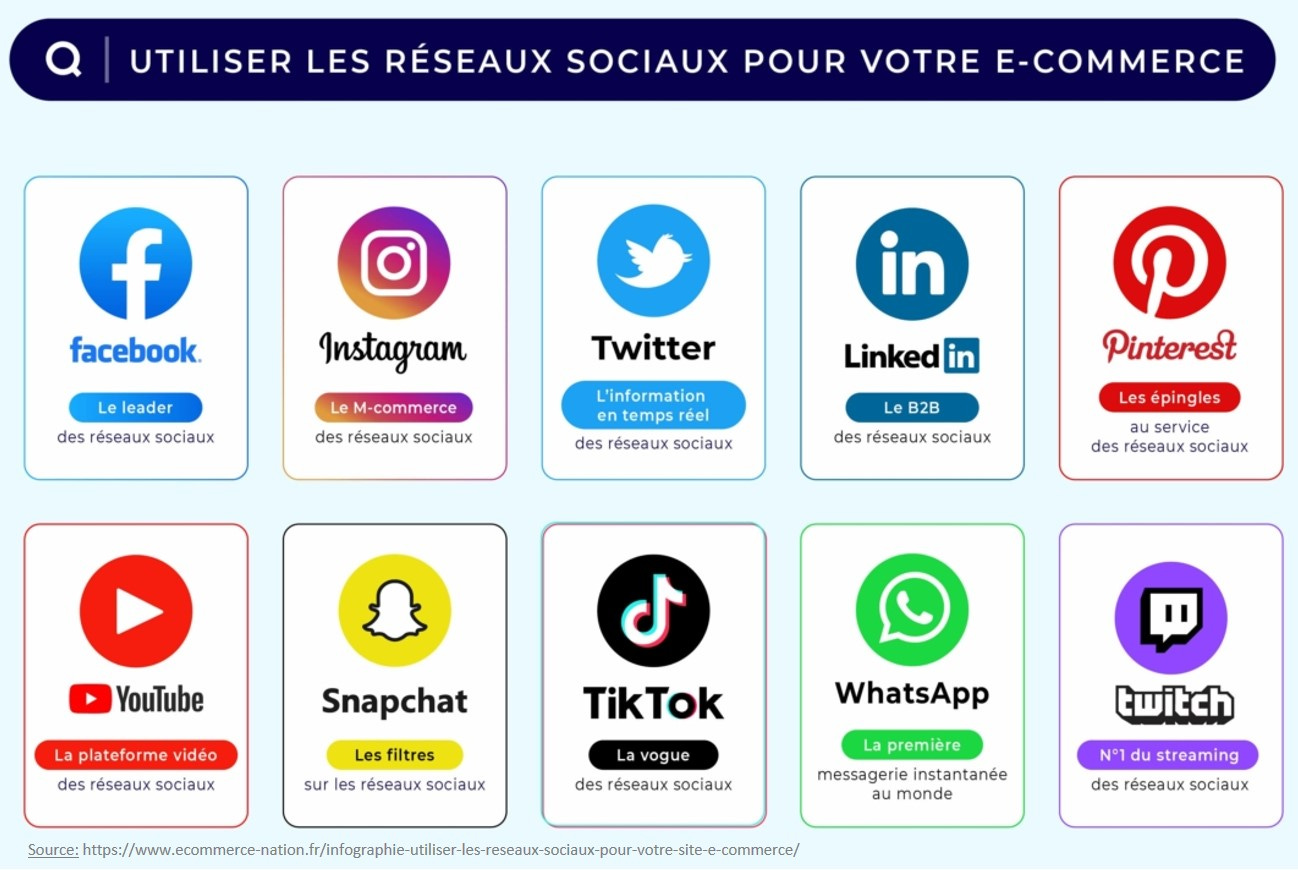

To go further and better understand the characteristics of each of the networks, we invite you to read the well-detailed guide of E-commerce Nation available in French here.

🚚 Micro Fulfillment Centers

E-merchants know how much the delivery is as important as the shopping experience. The explosion of e-commerce has a direct impact on last-mile logistics. Havas recently released some data highlighting market trends :

The growth of the last-mile delivery market is expected to reach +78% by 2030;

Number of delivery vehicles in cities to reach +36%.

In addition to these challenges, there are consumer expectations:

For 72% of consumers, delivery is the most important criterion when making an online purchase;

85% are ready to switch to another e-merchant if they can have more delivery options;

50% expect 24h-free delivery;

55% say that a 2-hour delivery option would increase their loyalty to e-merchants.

Rethinking the ways of delivering parcels to individuals has become essential. And this can only be done today in consultation with all stakeholders, e-merchants, logisticians as well as cities whose political decisions will directly impact the market.

Will urban micro fulfillment centers be the solution to both meet the demands of consumers and the new challenges of e-commerce ? They could be a solution to several issues :

Bring logistics closer to the end consumer to optimize the last mile;

Massify logistic flows to limit the number of delivery vehicles ;

Allow the use of more ecological means of ecological travel.

Initiatives are multiplying like Altarea-Cogedim, a mall operator which announced last week its project to help optimize the delivery of goods to the heart of city centers by transforming existing real estate assets into assets dedicated to urban and last-mile logistics. A first logistics center is planned in Paris in the coming months.

Another interesting initiative is taking place in the United States. After a first trial realized 2 years ago, Walmart is now opening mini-warehouses in a hundred supermarkets. These automated in-store fulfillment centers can operate 1.000 orders a day in a space as small as 1.000 m² while manual picking is limited to 100 orders a day. Other US retailers are considering launching similar initiatives. This is just the beginning of the transformation of last-mile logistics.

🔗 Marketplaces vs Brands : who owns the customer?

As we regularly cover in our newsletters, most of the brands are now working to recover the direct customer relationship by shrinking the retailer. The latest example is Adidas which announced last week that they plan to achieve 50% direct-to-consumer revenues by 2025 (80% of its growth). As marketing technology becomes more and more accurate, customer data is like gold for brands.

Starting on April 8, 2021, Amazon will no longer share customer data (name and addresses) with third-party sellers who use the Amazon fulfillment service in the US, unless they explicitly need it, especially for tax purposes or customer support.

Amazon has never been very generous with third party-sellers as complete data such as email addresses or demographics data are not shared. But worse, as explained by Michael Waters in “The growing customer data war”, customer data has become an especially touchy subject in the third-party seller universe because of accusations that Amazon has used data from the marketplace in order to build competing products then sold as Amazon Basics products.

This situation raises the question of the ownership of the customer and its data.

Marketplaces provide an infrastructure tool, value-added services (product promotion, logistics, etc.), and access to a considerable volume of customers.

Third-party sellers are in charge of product sourcing and sometimes design, production, and branding. But they mainly are responsible for the quality and have to ensure the quality, therefore the guarantee and after-sales service.

Beyond the contractual subject, who really is the most legitimate as both players need each other to operate ? The question will not be that easy to answer.

📰 Bye Bye print catalogs ?

Print catalogs have been a key promotional tool for retailers for a long time. Its replacement by digital marketing has been predicted several times, but paper is still resisting.

However, print catalogs could finally be closer to the end than ever under the pressure of environmental, economic, and regulatory factors:

Harmonization of European laws which already prohibit the print catalog in some European countries;

Especially in France, the “Stop Pub” system should switch to an opt-in "Oui Pub" approach. Each consumer would have to explicitly indicate that he or she wants to receive a print catalog in his letterbox;

The foreseeable disappearance of the cash register receipt and paper reduction coupons;

The Covid-19 pandemic has given brands and retailers a taste of digital marketing allowing better reach and more reliable measurement of ROI.

As an example, Ikea announced that they will stop printing their catalog in 2021. On the supermarket side, initiatives are more timid. After Auchan, which experimented with zero paper marketing last year in one of its stores, Leclerc is following the trends this year, with a single store as well.

If we welcome the initiative, we can only note the timidity of the supermarket players to embark on such an adventure. To fully understand the challenges at the societal level, our friend Laurent Landel (CEO of Bonial) and Olivier Dauvers who is no longer presented, published a very interesting study to understand how French consumers are considering the print catalog. The main lessons are :

69% of respondents did not apply a Stop Pub sticker to their mailbox but 49% consider it;

75% are in favor of Oui Pub system;

The younger the respondents, the more their sensitivity to print advertising increases. 40% of people under 34yo have applied a Stop Pub sticker ;

55% of respondents find the paper catalog nevertheless useful, especially among the youngest (over 60% of those under 35yo);

80% of respondents consider that the marketing approach relying on print catalogs is harmful to the environment;

However, the convenience of paper versus digital media is highlighted by all groups of respondents, even if 72% of them are ready to switch to digital.

The market is finally slowly moving forward; new retail media solutions will certainly be major drivers to help change habits.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a French investment fund dedicated to companies that are shaping the future of commerce. We invest both in Enablers, B2B companies providing innovative solutions to (e)retailers and brands, and Disrupters creating new models of distribution. Our investment approach relies on strong relationships with 50+ European Retailers and Brands in order to provide sales acceleration to our portfolio. We also provide operational support with a dedicated team of Venture Partners working with our portfolio on sales, communication, HR, and internationalization.