Retail Chronicles | 21.12.2020

Emerging trends in retail and new commerce.

Hello, it’s Xavier from Spring Invest, a French investment fund dedicated to RetailTech. Welcome to the latest edition of Retail Chronicles, our bi-monthly newsletter about emerging trends in retail, brands, and new commerce.

🚚 Delivery moving up the stack

In our latest chronicles, we talked about Facebook moving down the stack with its acquisition of Kustomer.

Now, FedEx is moving up the stack with its acquisition of Shoprunner. It makes a lot of sense. Delivery is hard, and the combination of the covid-related boost of e-commerce and the holiday season has produced a tremendous growth in volumes, which has been very hard to cope with. Also, merchants have realized that delivery is a major element of their customers’ experience.

The strategic position of efficient delivery players is strengthening, as evidenced by their ability to impose added fees for holiday delivery. Is this solid enough to serve as a building block for a vertically integrated e-commerce platform?

At Spring Invest, we believe so. We’re confident delivery’s critical importance will extend into 2021 and further. We see e-commerce gravitating around 3 power nodes:

Shopify owns merchants

Facebook (and Google, Tiktok, and other social media) own consumers

FedEx, UPS, DHL, DPD… own delivery

And of course, Amazon owns everything.

🗺️ Mapping the creator economy

In 2007, a close friend of my wife started a fashion brand in NYC. It was a nightmare. Her products were great, but the barriers to entry were too high. The stores would not give her shelf space if the brand were not established but she needed stores to exist. The brand folded after 3 agonizing seasons.

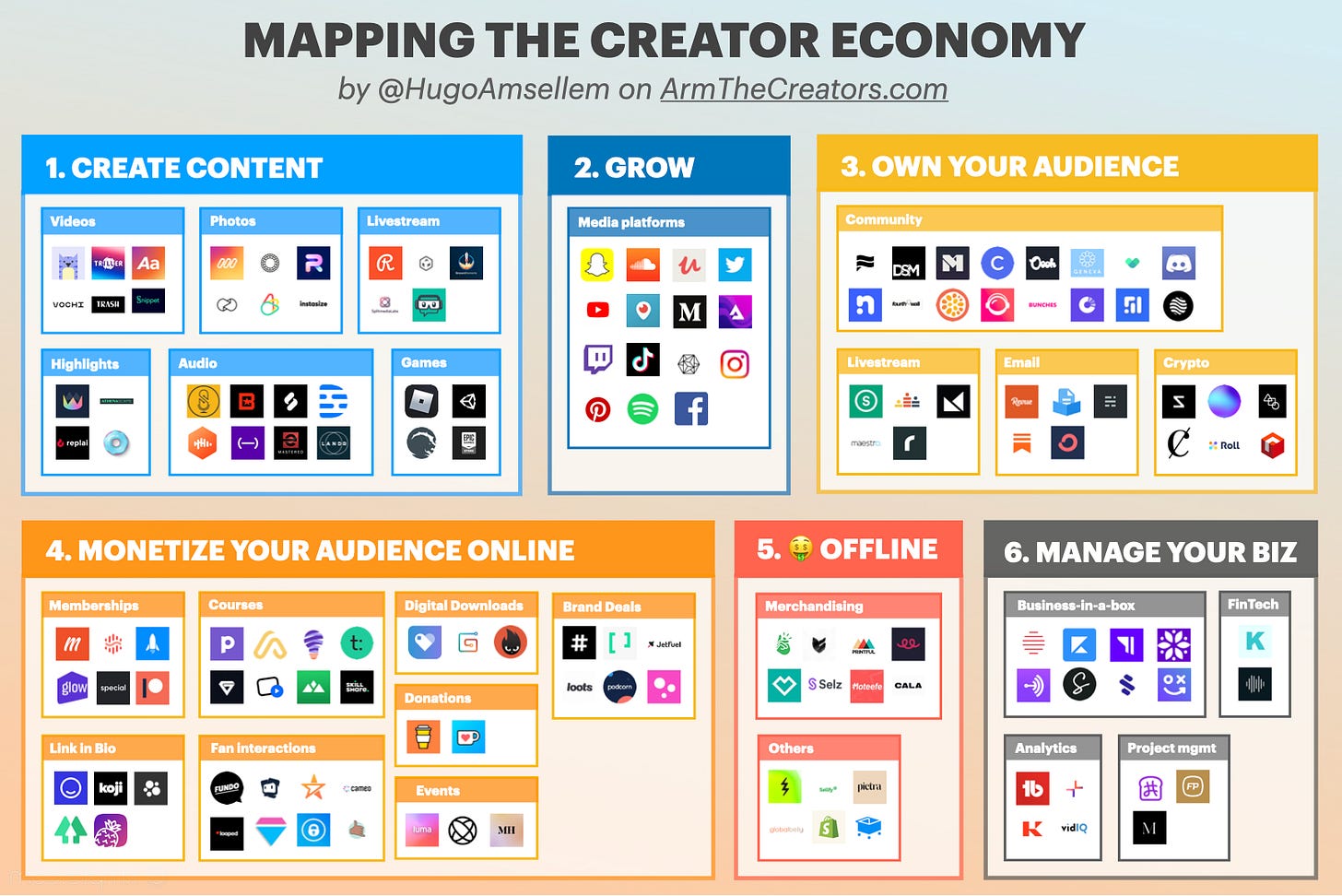

Fast forward 13 years, today is a completely different world. Creators have multiple ways to connect to consumers. Hugo Amsellem took it upon himself to map the whole creator economy: all the tools a creator can leverage to build content, grow their audience, convert that audience from rented to owned, monetize online or offline, and generally operate their business.

This is awesome work, many thanks to Hugo for giving it to the community.

📊 Marketplaces in 2020

Juozas Kaziukènas gathered a lot of data about marketplaces in 2020 (not only Amazon) with a lot of interesting and even surprising findings. Main takeaways are:

The data indicates that it is getting harder for large sellers to continue growing because it is getting easier for new sellers to start selling. There are 1,7 million sellers on Amazon, 850 make 10% of the volume but more than 38,000 are responsible for 50%.

Selling on Amazon is a long-term business, more than 50% of the volume is made by sellers who joined in 2017 or earlier. Also, 95% of the top 10,000 sellers in a given year are still active after 1 year, 90% after 2 years, and 85% after 3 years.

Chinese sellers represent 42% of the volume on Amazon.com, their importance ranges from 32% in Japan to 56% in Canada. Interestingly there a few domestic sellers on Amazon.fr, suggesting significant room for improvement.

Anker goes public: we already talked about Amazon-Native brands in our Nov 23 Chronicles. Anker, a Chinese seller of high-tech accessories surpassing $1Bn sales went public in August in Shenzhen. Its market capitalization exceeds $8Bn.

Amazon product reviews: Amazon introduced 1-tap rating in October last year. Dramatically reducing the hassle on the reviewer increased the number of reviews more than 5-fold for top100 products. This had also the effect of somehow drowning fake reviews but reducing the overall quality of feedback.

Amazon private labels: perhaps surprisingly, the number of best-selling AmazonBasics products has flatlined and even slightly decreased over the latest 18 months. Amazon seems to be struggling to expand beyond the obvious batteries and cable categories.

🔮 Shopify’s future of commerce 2021

Our friends at Shopify published their first report on the future of commerce, based on a survey of consumers and analysis of transaction data. While we weren’t particularly surprised by most results, it’s nice to have data to support some intuitions.

Specifically, Shopify measured the consumer’s shift to omnichannel. The pandemic has made many consumers hesitant to shop in stores but has significantly increased their use of an alternative pickup and delivery methods. Specifically, 30% of consumers used pickup in store for the first time and 64% expect to do this more often.

Also, while it may sound self-serving, Shopify identified a significant drive for consumers towards independent stores. 57% of consumers show an intention to shop with independent but only 29% actually did.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring Invest is a French investment fund dedicated to companies that are shaping the future of retail. We invest both in Enablers, B2B companies providing innovative solutions to (e)retailers and brands, and Disrupters creating new models of distribution. Our investment approach relies on strong relationships with 50+ European Retailers and Brands in order to provide sales acceleration to our portfolio. We also provide operational support with a dedicated team of Venture Partners working with our portfolio on sales, communication, HR, and internationalization.