Retail Chronicles | 23.07.2020

Emerging trends in retail and new commerce.

Hello, it’s Xavier from Spring Invest, a French investment fund dedicated to RetailTech. Welcome to our last edition of Retail Chronicles, our bi-monthly newsletter about emerging trends in retail and new commerce.

🤝 We’re very happy to announce Spring’s first investment in smart accessory brand Cabaia.

Cabaia is an ONVB (Omnichannel-Native Vertical Brand), a brand designed to exploit every possible retail channel, online or offline, direct or indirect. They make fashion accessories (beanies, backpacks, socks…) and sell directly on their website, in pop-up stores or corners and indirectly with a 1000 stores strong wholesale network.

In only 4 years, Cabaia reached 7m€ revenue, they are among the fastest-growing brands in France. Cabaia is already profitable.

Our investment rationale relies on:

A tremendously talented team both creative and rigorous;

An innovative retail model, very hard to execute, allowing strong profitable growth while reducing risk and channel-dependency;

Cutting-edge advertising ROI analysis tools, allowing to optimize costs and profit from any market imbalance on Facebook ads and other platforms;

Strong growth potential : Cabaia is a mass-market brand with rich opportunities for new products and they have barely started to open new geographies;

Cabaia is a mission-driven brand with a strong commitment to the animal cause and the environment.

These strengths were highlighted during the covid lockdown. Cabaia was able to brush off the interruption of 2 out of its 3 distribution channels (pop-up stores and wholesale) between March 15th and May 11th, then took advantage of reduced competition of Facebook ad buying to more than double its e-commerce footprint. Then Cabaia managed to launch health-compliant face masks in April and relaunch a product line (backpacks) in May. All of this allowed Cabaia to end Q2 above its pre-covid revenue and margin budget!

⚔️ Another great piece by Ben Thompson’s Stratechery about the rivalry between Apple and Facebook.

At first glance, the cosmic conflict between app-based Internet and web-based Internet may seem irrelevant for the retail industry, but Thompson zooms in on Facebook’s unique advertising model.

While TV advertising is strongly concentrated on the major CPGs (the top 200 advertisers make up 80% of TV ad spending), Facebook is far more diversified with its top 100 advertisers representing less than 20% of its ad revenue. Facebook is in effect serving a long tail of 8 million advertisers.

Since Facebook ads have short-term, measurable ROI, any decrease in prices improves ROI for advertisers, thus generating near-infinite demand. Therefore, Facebook has a very low dependency on any individual advertiser, even the biggest. As Ben Thompson puts it:

“This explains why the news about large CPG companies boycotting Facebook is, from a financial perspective, simply not a big deal. Unilever’s $11.8 million in U.S. ad spend, to take one example, is replaced with the same automated efficiency that Facebook’s timeline ensures you never run out of content. Moreover, while Facebook loses some top-line revenue — in an auction-based system, less demand corresponds to lower prices — the companies that are the most likely to take advantage of those lower prices are those that would not exist without Facebook, like the direct-to-consumer companies trying to steal customers from massive conglomerates like Unilever.”

As a matter of fact, most Direct-to-Consumer brands we meet invest heavily on Facebook ads. The best ones, like Cabaia mentioned above, have a near-instant monitoring of their ad performance and are able to systematically profit from any “market imbalance” in Facebook’s pricing.

📊 Fevad has released data on the purchasing habits of French consumer during and after lockdown. (French)

This puts numbers on the acceleration of e-commerce that everybody noticed. But the numbers are impressive. While before covid 50% of consumers made at least a purchase online in the previous MONTH, that number rose to 76% in the previous WEEK during lockdown, and a whopping 81% in the previous WEEK in June, post lockdown.

Fevad also published its key figures for e-commerce in 2020. (French, English)

⚠️ News from the retail apocalypse, this time in the US.

Forbes took count of the closures and totals more than 10,000 stores in the US so far in 2020, and more to come. Roughly half come from bankruptcy and half from physical footprint reduction.

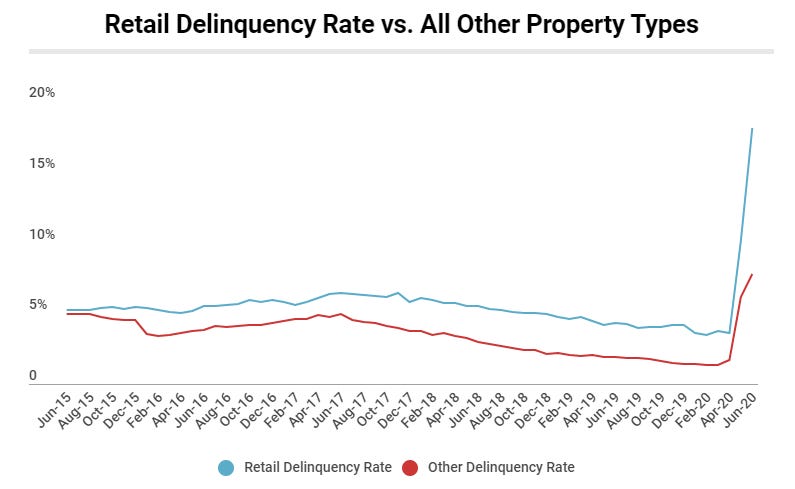

On a related note, Trepp, a market data analysis platform published figures on the retail delinquency rates for CMBS (Commercial Mortgage-Backed Security) loans. Predictably, it’s savage.

📰 VC Matt Higgins is interviewed about the DTC backlash by ModernRetail.

Key quote :

I think it’s amazing that you can (…) go ahead and create an entirely new cereal brand, launch it right away and get scale. That’s not going away. What is going away is the idea that digitally-native companies can stick solely to the online world and survive. That part is not true, but it’s kind of obvious, looking back. You’re going to go where the customer is.

Of course, we love this quote. It’s 100% aligned with our view of Omnichannel-Native Vertical Brands and our investment rationale for Cabaia. (see above)

😷 Power Retail is providing some common-sense recommendations in preparation for a second wave of the pandemic.

Main points are:

Ramp-up online offering

Adapt product offering

Shorten supply chains and work with local suppliers

Enable click and collect and contactless payment

♟️ Carrefour is ramping-up its corner strategy. (French)

After Darty (appliances), Aubert (baby), Pacific Peche (fishing wares), and Cash Converter (pawn shops), Carrefour is opening a corner operated by Noa (Pet food) in its St Brice store. The Noa corner is autonomous from Carrefour, they manage the merchandising and operate the cashiers. Noa just pays a fixed rent to Carrefour.

This is a very clever answer to the problem of large surfaces ill-adapted to recent market evolutions. It allows the retailer to better leverage its magnet status and improves the experience for the customers.

Interestingly, the frontier between retailers and malls is now blurring, the same way the frontier between retailers and brands has been blurring for decades.

This is a trend to watch in the near future. Many retailers are experimenting with this. For instance, Franprix has invited Decathlon (sport wares) to open corners in some of its stores. Cabaia (mentioned above) is uniquely positioned to benefit from this trend.

👍 If you like Retail Chronicles and want to help it grow, please share this newsletter with your colleagues, followers, and friends. If you hate it, then send it to your enemies. Have a great day, and see you soon!

About us

Spring is a French investment fund dedicated to companies that are shaping the future of retail. We invest both in Enablers, B2B companies providing innovative solutions to (e)retailers, and Disrupters creating new models of distribution. Our investment approach relies on strong relationships with 50+ European Retailers in order to provide sales acceleration to our portfolio. We also provide operational support with a dedicated team of Venture Partners working with our portfolio on sales, communication, HR, and internationalization.